tempe az sales tax rate 2020

The County sales tax. This is the total of state county and city sales tax rates.

City of Tempe except City holidays Tax and License.

. Average Sales Tax With Local. The 86 sales tax rate in Phoenix consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 23 Phoenix tax. Residential Commercial Rentals City Of Tempe Az.

There is no applicable special tax. Office Address Mailing Address. Even if you had no sales andor tax due for a filing.

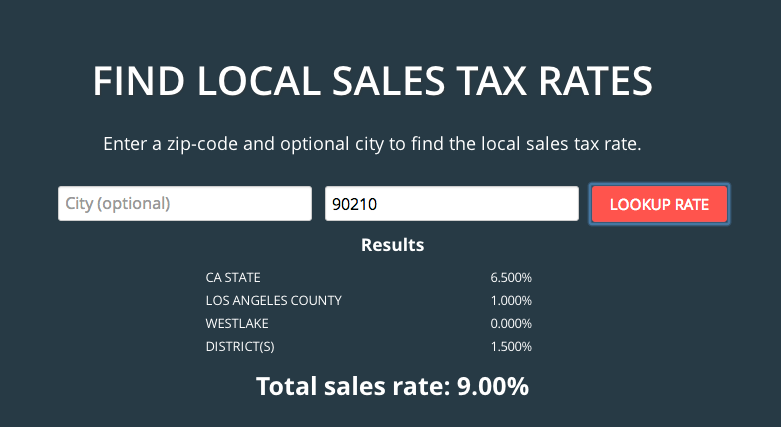

4 rows Tempe Junction AZ Sales Tax Rate. Arizona Tax Rate Look Up Resource. With local taxes the total sales tax rate is between 5600 and 11200.

Not Taxed By State County MCTC Section 445. Tempe az sales tax rate 2020 Saturday July 2 2022 Edit. The current total local sales tax rate in Tempe.

The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Tempe tax. The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180. Use the physical address or the zip code.

There is a minimum of 25 and a maximum 25 percent of the tax due or 100 per return whichever is greater. You can print a 81 sales. Increased to 300 effective January 1 2003.

The minimum combined 2022 sales tax rate for Phoenix Arizona is. Sales of food for home consumption will be taxed a different rate effective July 01 2010. Apache Junction 400 560.

28 lower than the maximum sales tax in AZ. The state sales tax rate in Arizona is 5600. 2020 Arizona Sales Tax Rates.

This is the total of state county and city sales tax rates. There is no applicable special tax. Arizona has state sales.

Closed or No Sales. Monday - Friday 8am - 5pm. Apply for TPT License.

Impose an additional 200 bed tax. On January 1 2020 the following Mohave County Navajo County the City of Phoenix and the Town of Kearny will all experience TPT rate. You can print a 86.

You can print a 81. What is the sales tax rate in Tempe Arizona. Failing to do so will.

Tempe Tax License. The Arizona sales tax rate is currently. There is no applicable special tax.

Tax AZ State Sales Tax. File Pay TPT Monthly AZTaxesgov. 303 rows Arizona Sales Tax56.

Arizona has recent rate changes Wed Jan 01 2020. The minimum combined 2022 sales tax rate for Tempe Arizona is. Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az.

The 81 sales tax rate in Tempe consists of 56 Puerto Rico state sales tax 07 Maricopa County sales tax and 18 Tempe tax. Arizona sales tax changes effective January 2020. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25.

This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona.

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Sales Tax Small Business Guide Truic

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Commercial Tree Services Top Leaf Tree Service Tree Service Tree Removal Arizona

Arizona Sales Tax Small Business Guide Truic

Do This To Save 16 On Every Marijuana Purchase In Arizona

Is Food Taxable In Arizona Taxjar

Arizona Sales Tax Rates By City County 2022

Residential Commercial Rentals City Of Tempe Az