canadian tax strategies for high income earners

Taxpayers in the middle income quintile those with income between about 49000 and 86000 received an average tax cut of about 800 or 14 percent of after-tax income. Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie.

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

The main reason is that youre able to recover the cost of income-producing property.

. Convert your traditional SEP or SIMPLE IRA to a Roth. If you own a business changing your business structure can be a very effective tax reduction strategy for high-income earners. Bonds mature with an initial return for the buyer.

The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions. They borrow cash in exchange for fixed payments. We provide you with information on converting to a Roth IRA You can buy municipal bonds.

Interest payments on the earnings are tax-free. Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner. The more money you make the more taxes you pay.

So what are the top tax planning strategies for high income employees. Take advantage of vehicles for future tax-free income. For high income earners Please contact us for more information about the topics discussed in this article.

The math is simple. The standard deduction for single taxpayers and married taxpayers filing separately. Utilize RRSPs TFSAs RESPs to the max.

Income-splitting and prescribed rate loans While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there are benefits for the average Canadian too. As a refresher for 2021 FY the individual tax rates including medicare levy are. Make sure you have enough money to pay for your retirement.

More than a quarter of Canadians who make over 400000 a year paid less than 15 per cent in federal personal income taxes in 2019 according to. Tax minimization strategies for individuals Income splitting with family members Family income splitting is a fundamental tax planning strategy but many Canadians are not taking advantage of simple income. Formerly known as the Working Income Tax Benefit WITB the Canada Workers Benefit CWB is a refundable tax credit for Canadians with a low income.

Save money by opening a health savings account. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Make a heartfelt donation and keep the receipt.

This has to generally be done within annual gift exclusions or loans. Also if youre planning on being a high income earner in your retirement then an rrsp might not be as beneficial to you as youll still be taxed in a high tax bracket. The government is not against helping tax payers minimize their tax bills legally.

Tax Saving Strategies for High-Income Earners. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

Real Estate whose inheritance has been passed down. Qualified Charitable Distributions QCD 4. Tax Deductions For High Income Earners 2019.

Keep reading to find out five effective tips that you should be utilizing right now. Contributing to a retirement plan deducting interest and small. Tax planning for high.

Those who qualify will receive 26 of every dollar they make over 3000 up. Convert your SIMPLE SEP or traditional IRA to a Roth IRA. Individuals making between 3000 to 24112 and families with incomes below 36482 are eligible for the tax credit.

As a refresher for 2021 fy the individual tax rates including medicare levy are. Split your income or pension with your spouse. Create your own fund to solicit funds from donors.

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. Contribute to your Superannuation Fund. Your RRSP limit for the current year 2018 is shown on your 2017 Notice of Assessment.

Here are some options. Creating retirement accounts is one of the great tax reduction. The deduction is meaningful with 5000 for single filers and 10000 for married.

Spousal Registered Retirement Savings Plan Spousal RRSP Flow-Through Shares. 6 Tax Strategies for High Net Worth Individuals. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax shelter is that its less flexible.

One of the easiest ways to begin slashing your annual income tax bill is by. RRSP withdrawals are taxed at your marginal tax rate. Preparing a strategy and formulating a financial plan is key to being prepared.

Canadian tax law allows for several ways to reduce your taxes owed if you know the current rules and can take advantage of them. Max Out Your Retirement Account. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Tax Saving Strategies For High Income Earners Canada. Taxpayers in the 95th to 99th income percentiles those with income between about 308000 and 733000 received the biggest benefit with an.

With a DAF you can make a. 1 Ad Make Tax-Smart Investing Part of Your Tax Planning. A donor-advised fund DAF is an investment account created to support charitable organizations.

Look into your principal residence exemption. July 1 2021 Insights. Specifically contribute to a traditional 401 k or IRA.

Canadian Tax Tricks There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

After age 59-½ if youve met the five-year rule Roth distributions are generally tax-free. Withdrawals get hit with a withholding tax that is paid upon withdrawal. How to Reduce Taxable Income.

6 Tax Strategies for High Net Worth Individuals. If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. High-income earners should consider investing in municipal bonds.

On the other hand tax. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. Tax Planning for High Income Canadians.

Canadian tax law allows for several ways to reduce your taxes owed if you know the current. While income splitting between family members may no longer be viable the new rules do not prevent higher income spouses from. The earnings of the tax-exempt bond are typically excluded from income taxes including state income taxes and local income tax rates.

For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is. How Can High Earners Reduce Taxable Income. If youre wondering why you should do so here are some of the ways it can help you to lower your tax bill.

RRSP limit for the year. Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. If one spouse is in a higher tax bracket than another they may want to shift some of that taxable income to another family member including children.

A great example of a safe tax-avoidance strategy is the RRSP Registered Retirement Savings Plans.

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

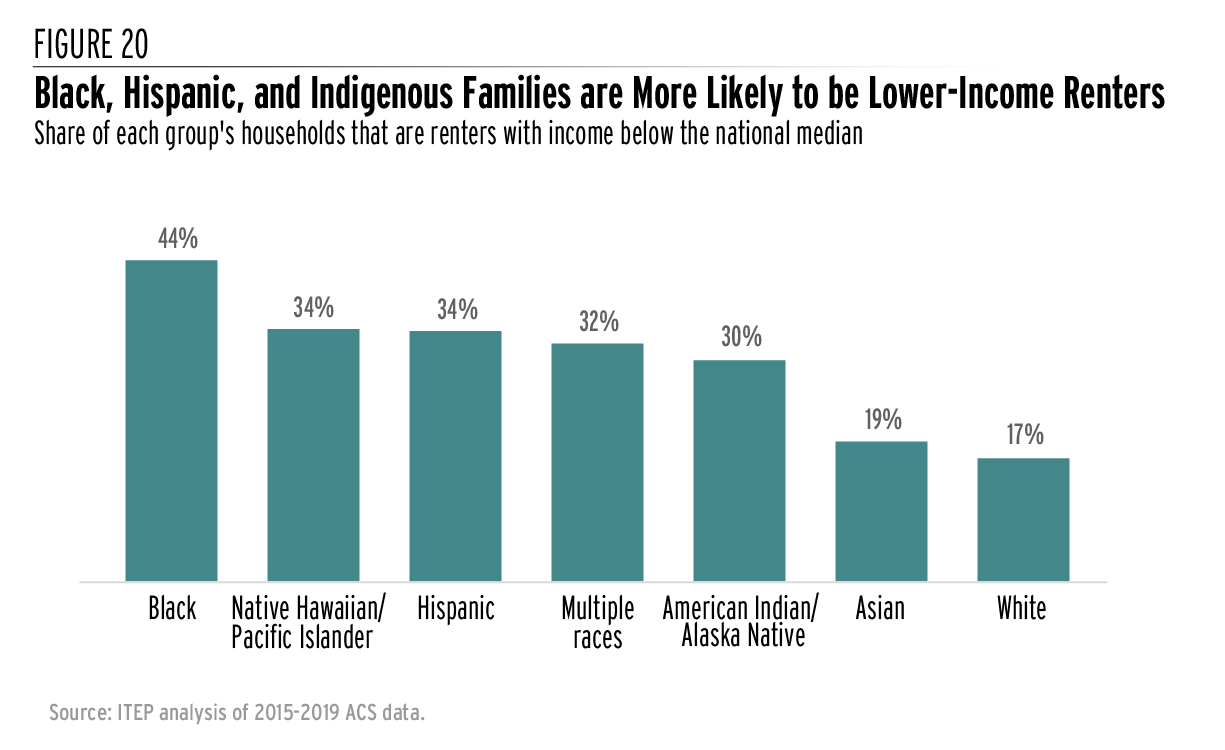

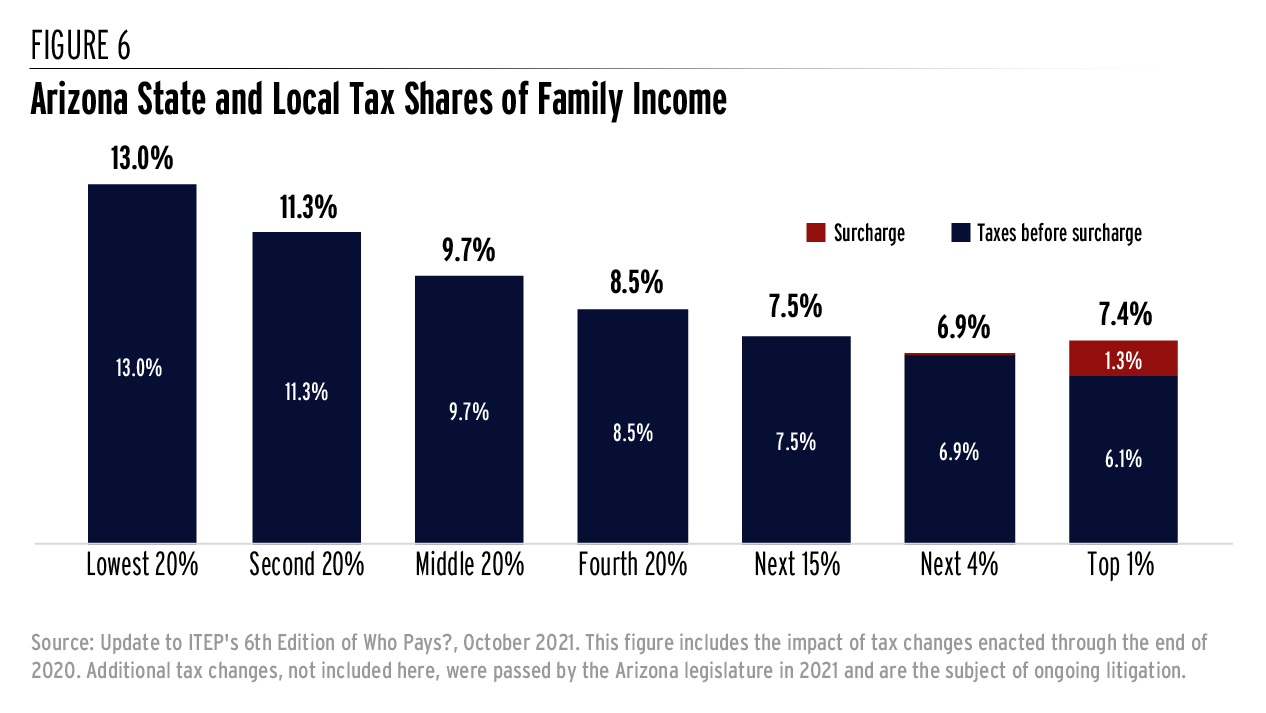

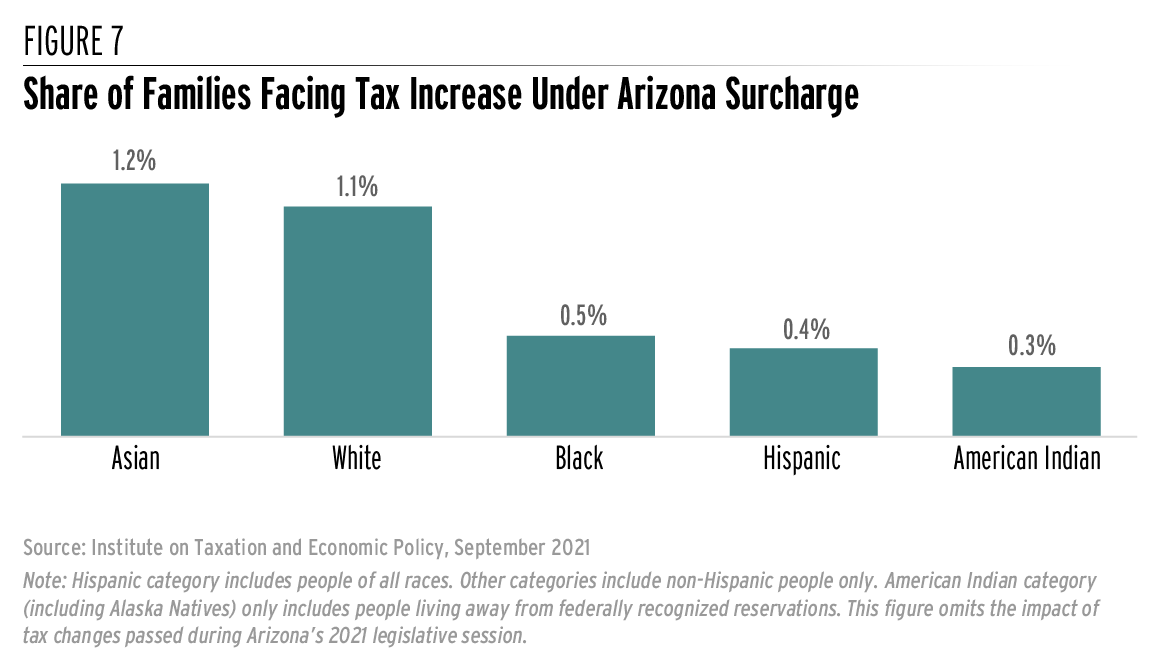

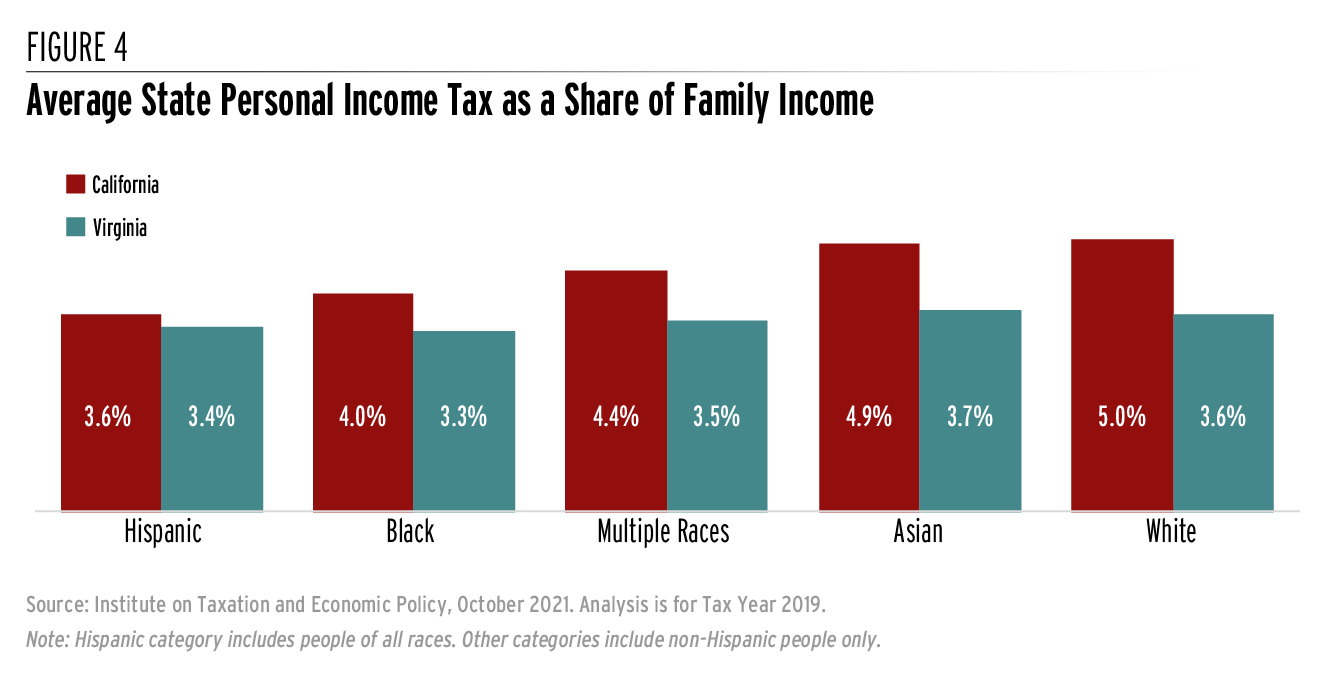

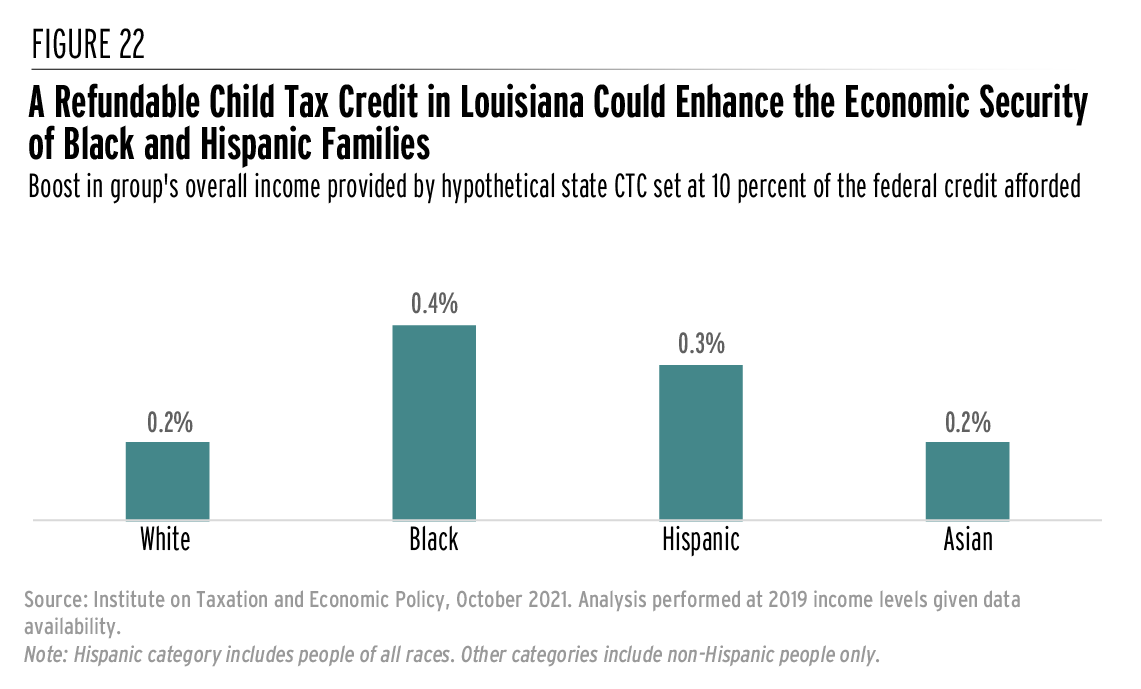

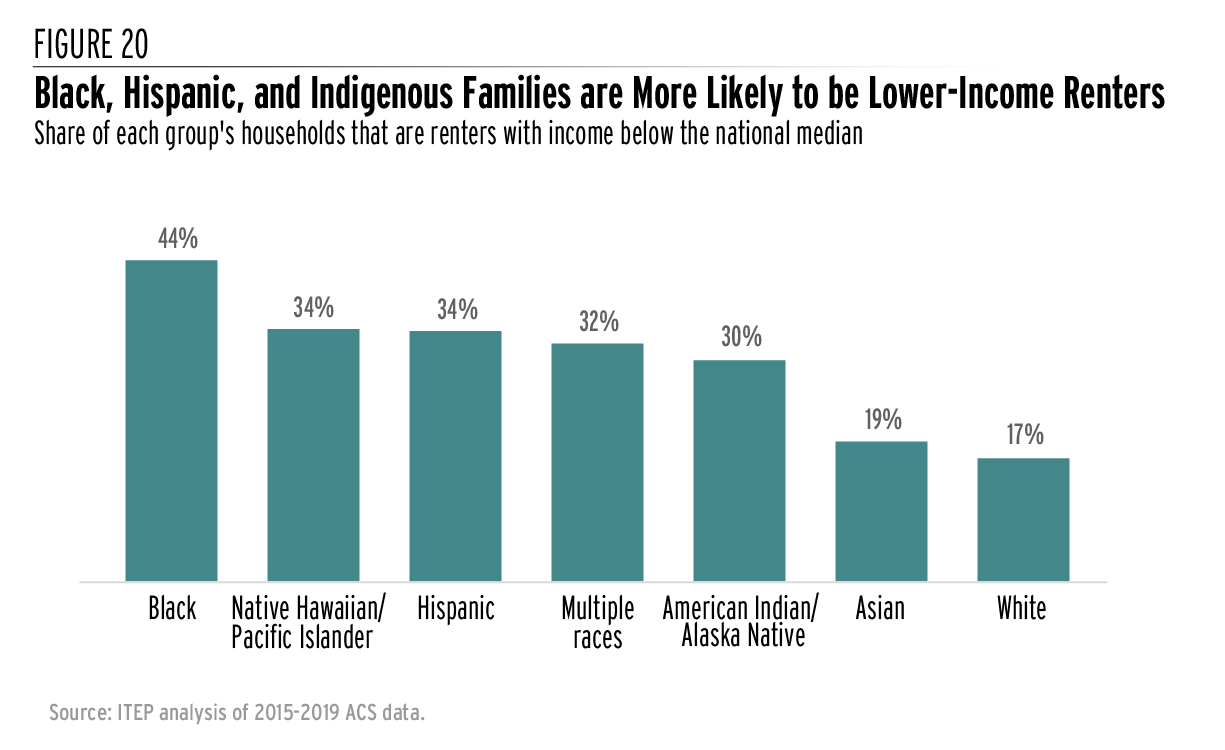

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How To Reduce Taxes For High Income Earners In Canada

Become A Canadian Millionaire With 16 50 Per Day The Tfsa Explained Youtube In 2022 How To Become Millionaire Finance Tips

Annual S P Sector Performance Novel Investor Stock Market Performance Charts And Graphs

How Much Would The Government Tax On A Canadian 300k Salary Quora

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

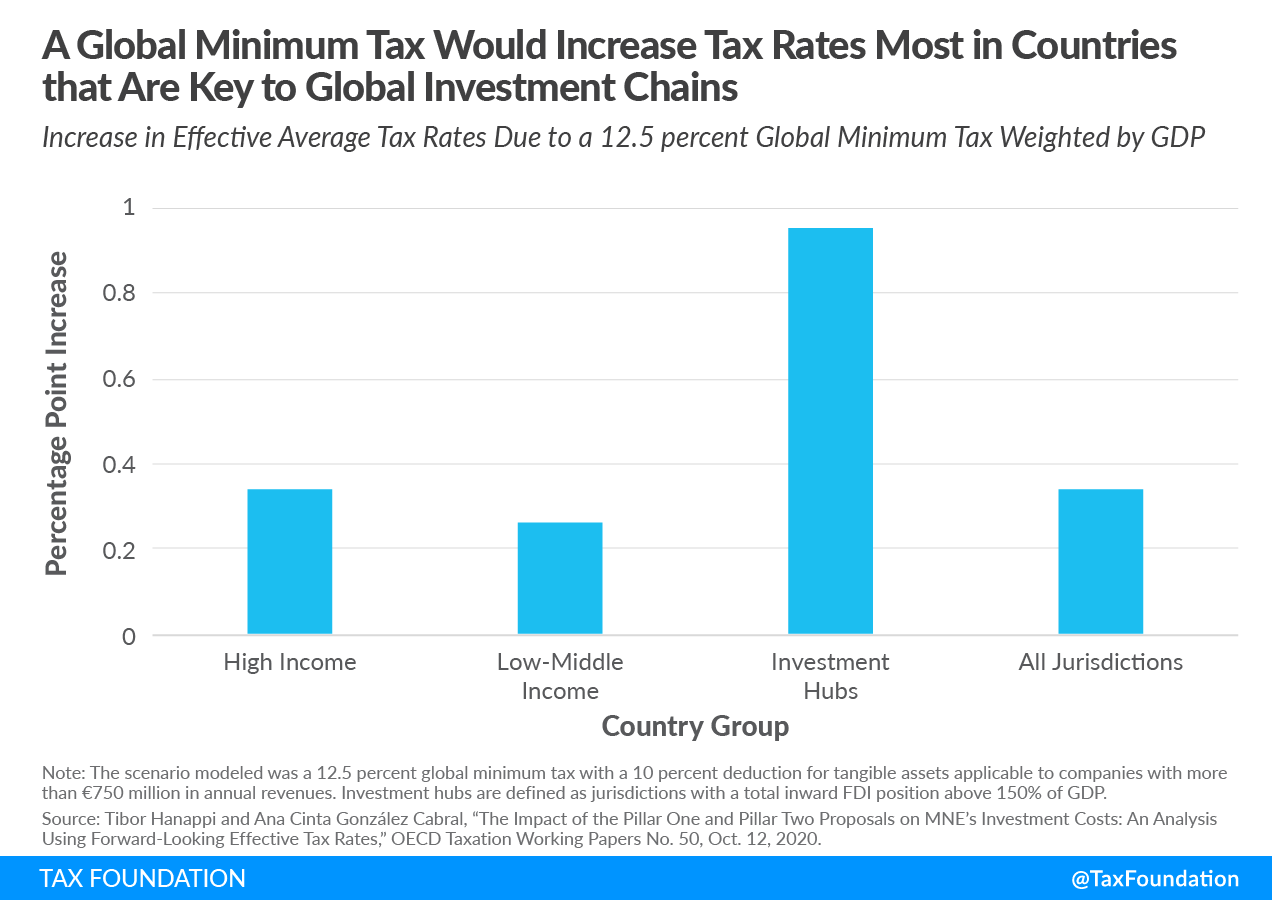

Korea Tax Income Taxes In Korea Tax Foundation

How Is Taxable Income Calculated

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

How Is Taxable Income Calculated

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

30 Ways To Pay Less Income Tax In Canada For 2022 Hardbacon

Individual Retirement Accounts Iras Prosperity Financial Group San Ramon Ca

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

How Much Would The Government Tax On A Canadian 300k Salary Quora

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep